Bitcoin After $126K: Liquidity, Structure, and What Comes Next

In the crypto markets, emotion is expensive.

While social media swings between panic and euphoria on every candle, professionals focus on market structure, liquidity, and higher-timeframe context. Price does not move randomly — it moves with intention, toward areas where capital is concentrated.

Right now, Bitcoin is at a critical transition point. Short-term price action may look chaotic, but when viewed through a professional lens, the broader roadmap becomes much clearer.

Today, I want to walk you through the exact framework I use at The Crypto Code to assess where Bitcoin is likely headed next — and, just as importantly, where the highest-probability opportunities will form.

The Macro View: The Secular Trend Remains Intact

To understand what comes next, we must start with the highest timeframe.

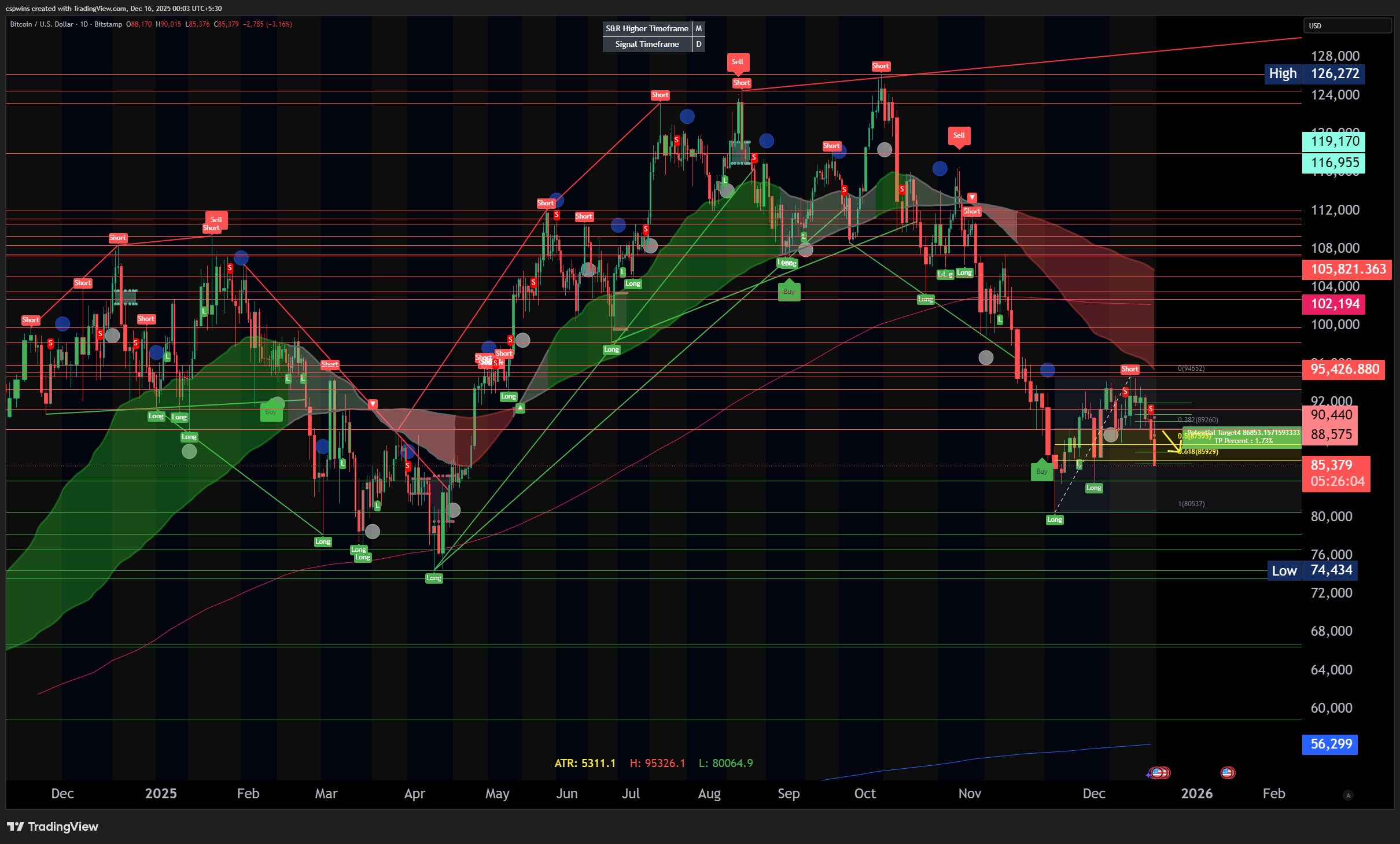

On the 2-week chart, Bitcoin continues to trade above its long-term dynamic trend structure — a zone that has historically defined the boundary between healthy bull markets and structural breakdowns. This trend ribbon currently spans roughly from the mid-$50,000s up into the low-$80,000s.

As long as price remains within or above this structure, the secular bull thesis remains intact.

What has changed is momentum. After an aggressive advance into the $126,000 region, long-term momentum indicators have cooled from historically overheated conditions and are now reverting toward neutral territory. This behavior is not a crash signal — it is a cycle reset.

Markets do not move from expansion to expansion without periods of digestion. Time-based and price-based corrections are a normal and necessary part of every mature bull cycle.

The $126,000 area now stands as a confirmed cycle extreme, and reclaiming it will require renewed accumulation, participation, and patience — not blind optimism.

The Micro View: Why Price Is Being Pulled Lower

If the long-term structure remains constructive, why does Bitcoin feel weak in the short term?

The answer lies in liquidity mechanics.

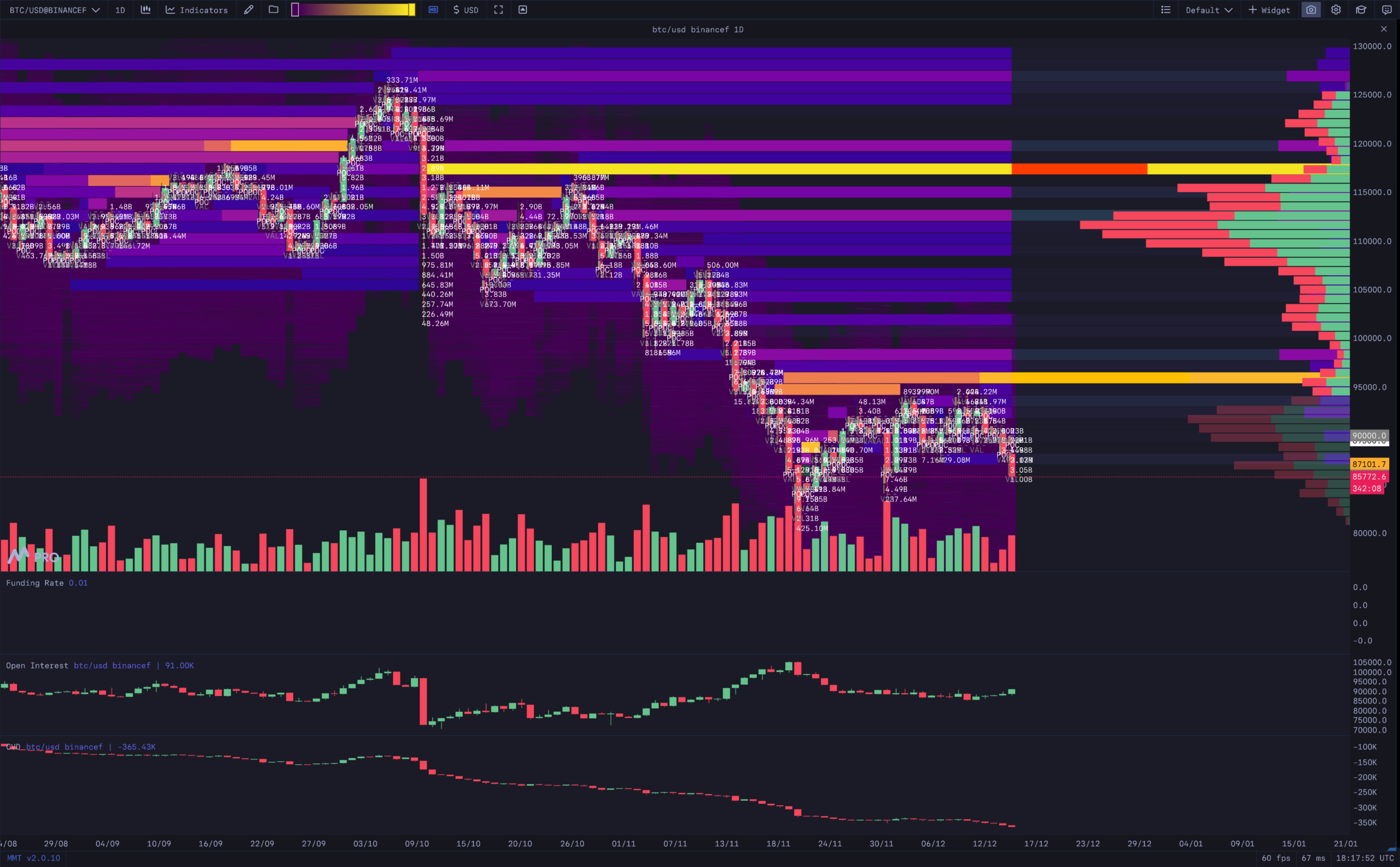

Price is attracted to areas where large clusters of orders exist. Liquidity heatmaps allow us to visualize these hidden zones of demand and supply — the real engine behind most short-term moves.

Currently, we can see well-defined liquidity pockets sitting below price in the $82,000–$85,000 region. These zones often act as magnets, drawing price lower as market makers seek to:

- Fill large institutional orders

- Flush out over-leveraged positioning

- Reset funding and sentiment

At the same time, significant overhead supply remains stacked between $95,000 and $100,000, forming a dense resistance band. This makes a clean, immediate breakout through $100k statistically unlikely without first building stronger structural support below.

This is not weakness — it is market efficiency at work.

Synthesizing the Data: Structure Before Expansion

When we combine macro structure with micro liquidity, a coherent picture emerges.

The recent downside is best understood as a post-ATH corrective phase, not a trend reversal. Markets routinely correct after tagging cycle extremes, and Bitcoin is no exception.

Here is the high-probability roadmap as I see it:

Immediate Short Term

Expect continued volatility and potentially a deeper pullback into the $82,000–$85,000 liquidity zone. This area aligns closely with higher-timeframe structural support and represents a natural region for stabilization.

Alternative Downside Scenario

If macro support fails to hold, deeper downside into the $70,000 range would represent a structural re-accumulation zone rather than a thesis-breaking event. These are the levels where longer-term capital historically begins positioning — not exiting.

Medium-Term Outlook

Once liquidity below is absorbed and leverage is reset, the path of least resistance can shift back to the upside, allowing Bitcoin to begin rebuilding toward the $100,000 psychological level.

Long-Term Perspective

A sustained reclaim of the prior $126,000 cycle extreme would require a full re-accumulation phase and renewed momentum — something markets typically demand time to construct, not something they give away easily.

Final Thoughts

Late-cycle corrections are where inexperienced traders panic — and where professionals prepare.

The goal is not to predict every candle. The goal is to understand structure, respect risk, and position when probability aligns with patience.

Short-term volatility is not your enemy. Emotional decision-making is.

Stick to the data. Respect the cycle. Let the market do the heavy lifting.

Joel Peterson

The Crypto Code

https://thecryptocode.com

Responses